Contents

Of course, these private space companies could not have made such a huge impact on the industry without the help of private investors. These investors include individuals (rich entrepreneurs who are looking to invest their money), private equity funds, angel networks, and capital venture investment firms.

Out of all these investors, capital venture investment firms have been the most active in the space industry, with an overall investment of more than $3 billion between 2010 and 2016.

Why are venture capital firms investing in space?

The significant increase in venture capital investments in the space industry leaves one to wonder why so many venture capital firms are quick to rush into an industry that has for a long time now been considered tricky to invest in. Below is a look at some of the main reasons I believe these firms are now investing in the final frontier.

The offer of an excellent investment opportunity

One of the things that is driving the venture investors in the space industry is the fact that the space industry has a huge potential for growth. Experts are predicting that the space industry will be worth more than $1.1 trillion by the year 2040, up from the current $350 billion.

What this means is that in the long run, venture capital firms that have invested in the final frontier will reap huge return on investments. As a result, investment firms from all over the world are rushing into the industry so that they can be able to reap the benefits of the industry’s growth for years to come.

The cost of space activities has dropped significantly

A few decades ago, reading about various space activities seemed like reading straight out of a science fiction novel. The activities sounded so foreign, and their cost was very high – enough to scare away any sane investor. However, this has since changed in the past few years, and the space economy is now transforming into a normal economy.

A few decades ago, reading about various space activities seemed like reading straight out of a science fiction novel. The activities sounded so foreign, and their cost was very high – enough to scare away any sane investor. However, this has since changed in the past few years, and the space economy is now transforming into a normal economy.

Some of the activities that used to be extremely expensive decades ago, for example, launching satellites and other spacecraft, have also become more affordable.

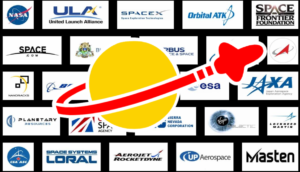

An increase in space companies and investors

A few decades ago, the space industry was monopolized national space agencies, which enjoyed government funding. As a result, it was hard for venture capital firms to invest in the industry. And since the main interest of a national space agency is not to make money, the industry was very unattractive to private investors. The situation has now changed with the entry of countless private space companies in the industry.

Since these companies do not enjoy government funding, their only option is to turn to private investors such as venture capital firms. Private space companies are motivated to make a profit. As a result, certain sections of the space industry have become more attractive to venture capital firms.

The growing number of investors that have a stake in the space industry is also another reason why investment is increasing at a significant rate. This has helped to show other investors that the final frontier is not as dangerous to invest in as what many people thought. Therefore, more and more venture capital firms are following the example and staking their interests in the industry.

The discovery of products that can be commercialized

One of the reasons why most investors are afraid to invest in the final frontier is the lack of products or services that can be commercialized. However, this has changed over the past few years, and the space industry is now full of products and services that can be commercialized to turn a profit.

One of the reasons why most investors are afraid to invest in the final frontier is the lack of products or services that can be commercialized. However, this has changed over the past few years, and the space industry is now full of products and services that can be commercialized to turn a profit.

A good example of this is satellites. Over the past decade, the commercial applications of satellites have increased significantly, and they are now used by a wide range of organizations and businesses in sectors such as energy and oil, military and security, agriculture, hedge funds, IT, and others.

Therefore, space companies that operate satellites or offer satellite launching services can make a good buck by selling their products and services.

The space industry is also on the verge of finally offering commercial spaceflight, which is expected to lead to a very successful space tourism industry. Experts in the space industry are also predicting that space mining is close to becoming a reality. These discoveries are thus expected to increase the commercial applications of the space frontier, something that has helped to attract several investors.

The prestige of investing in the space industry

For the adventurous investors, the space industry is the ultimate frontier to invest in. Investing in the space industry also comes with a lot of prestige, especially with the promise of being associated with historic space industry achievements. This has helped to attract several capital venture firms, which are looking to not only share in the glory or space, but also to help take the next giant leaps for mankind.

Challenges faced by venture capital companies

The risk of a bubble in the space industry

When an economy is growing at an exponential rate, the risk of a bubble is very serious. The risk of an investment bubble is something that has been facing the space industry for a while now, especially from the period after 2010 when investments in the industry skyrocketed. This risk is one of the major challenges facing venture capital firms that are looking to invest in the space industry, as they have to take a risk that their investments might not pan out.

High risks of a loss

In addition to what is considered by some industry experts as a looming bubble, venture capital companies investing in the space industry must also deal with a high risk of making a loss. Unlike most other sectors, the guarantees for a good return on investment are very low in the space industry.

In addition to what is considered by some industry experts as a looming bubble, venture capital companies investing in the space industry must also deal with a high risk of making a loss. Unlike most other sectors, the guarantees for a good return on investment are very low in the space industry.

On top of that, most of the private companies operating in the space industry are relatively new, and some do not even have a track record of making profits (especially those working on projects such as space mining and space tourism).

Therefore, investments in these companies are not guaranteed to bring any returns. Indeed, considering the fate of XCOR and others, many of these well meaning firms are likely to fold before they actually get off the ground.

The challenge of finding the right company

For venture capital firms looking to invest in the space industry, making a profit is all about investing in the right space company. However, given the large number of private companies operating in space, combined with the volatile nature of the space industry, finding the right company to invest in is not easy.

Firms that are most active in space investment

While investing in the space industry might be challenging, it still has several benefits as seen above. This is something that several venture capital firms have realized, which is why they are investing heavily in the final frontier. Below is a look at a range of organizations that have large stakes in the space industry.

1. Google

Google is one of the largest investors in the space industry. In February 2015, the tech giant invested $900 million in SpaceX. The investment was to support various space activities such as space transport, satellite manufacturing, and reusability of space equipment.

Google is one of the largest investors in the space industry. In February 2015, the tech giant invested $900 million in SpaceX. The investment was to support various space activities such as space transport, satellite manufacturing, and reusability of space equipment.

Google was also involved in another major transaction, the purchase of satellite company Skybox Imaging at the cost of $478 million. However, in 2017, Google sold Skybox imaging to Planet Labs (after renaming it to Terra Bella) for an undisclosed amount.

2. SoftBank Group

SoftBank Group is a Japanese venture capital firm with an interest in various sectors, including the space industry. In December 2016, SoftBank was the lead investor in a fundraising round for the satellite company OneWeb, which saw $1.2 billion raised. SoftBank’s investment was aimed at supporting the design and manufacture of next generation satellites, which would deliver fast and affordable internet connection to consumers.

3. Draper Fisher Jurvetson

Draper Fisher Jurveston, also known as DFJ, is another leading capital venture firm that has large interests in the space industry. The company’s first entry into the space sector was in 2015, when it became a lead investor in SpaceX.

Draper Fisher Jurveston, also known as DFJ, is another leading capital venture firm that has large interests in the space industry. The company’s first entry into the space sector was in 2015, when it became a lead investor in SpaceX.

According to Jurveston, one of the partners of the venture capital firm, the main reason why he invested in SpaceX was because he had always been a space enthusiast.

In an interview, Jurveston also gave the affordable prices of space activities and ease of determining commercial viability as two other reasons why DFJ invested in SpaceX.

Aside from SpaceX, DFJ has also invested in other space companies such as ALOHA Networks, Mpabox, Planet Labs, and HuaXun Microelectronics.

4. Bessemer Ventures

Bessemer Ventures is one of the most active venture capital firms with an investment portfolio that features nearly four hundred companies from all over the word. Out of these companies, three of them are in the space industry. These include:

- Skybox Imaging – before Skybox imaging was acquired by Google in 2014, Bessemer Ventures invested an undisclosed amount into the satellite company.

- Rocket Lab – in 2014, Bessemer Ventures invested in Rocket Lab, a space company that designs launch systems that are used to launch satellites into orbit.

- Spire – in 2015, Bessemer Ventures invested in Spire, a satellite powered data company

5. First Round Capital

First Round Capital is a seed-stage venture capital firm that has investments in hundreds of companies around the world, including some in the space industry. In 2015, First Round Capital was one of the major investors in the Series C Funding stage of Planet Labs – they also invested in two other space companies, the Climate Corp and Swift Navigation.

6. Founders Fund

Founders Fund is another top venture capital firm with vast investments in the space industry. It is one of the lead investors of the multi-billion space company SpaceX.

Founders Fund has also invested in four other space companies in the recent years: Accion Systems, Planet Labs, the Climate Corp and Moon Express.

7. Khosla Ventures

Khosla Ventures is another venture capital firm that offers early seed funding for startups. It has interests in the internet, computing, silicon technology, biotechnology, clean technology, mobile, and space tech sectors.

Its investments in the space tech sector include Rocket Labs, Skybox Imaging (before it was bought and sold by Google), and the Climate Corporation. It was a lead investor in Series A and Series B rounds of funding for Skybox imaging in 2009.

8. RRE Ventures

RRE Ventures is a US-based venture capital company that provides seed-stage funding to startups in the software, internet, and communications sectors. It has a large investment portfolio of over four hundred companies, including three in the space industry: Spaceflight Industries, Spire, and Accion Systems. It is a lead investor in both Spire and Spaceflight Industries.

9. Lux Capital

Lux Capital is a New York-based venture capital firms with interests in the science and technology sector. It is another one of the most active space industry investor having invested in three space tech companies so far: Planet Labs, Orbital Insight, and Kymeta.

Lux Capital is a New York-based venture capital firms with interests in the science and technology sector. It is another one of the most active space industry investor having invested in three space tech companies so far: Planet Labs, Orbital Insight, and Kymeta.

10. Data Collective

Data Collective is a venture capital firm that invests in big data, deep commute, and IT infrastructure startups. It is thus not surprising that some of their top investments would include companies in the space sector.

The firm’s main investment in the space industry was in the 2017 fundraising round for Rocket Labs. Data Collective, along with two other investors (Promus Ventures and an undisclosed investor) helped to raise $148 million that will be used for the design and development of orbital rockets to be used in the launch of microsatellites into orbit.

Final thoughts

For a long time, most investors shied away from putting their money in the space industry due to whole host of good reasons. However, in recent years, many people have come to realize that the space industry is more and more open for business, which has helped to attract a large number of investors.

The majority of these investors are capital venture firms who have poured in billions of dollars to various space companies in the past few years. However, this mix also includes super-wealthy ‘investors’ such as Jeff Bezos, who seems to be happy throwing around 3 million dollars into the pot every day.

The majority of these investors are capital venture firms who have poured in billions of dollars to various space companies in the past few years. However, this mix also includes super-wealthy ‘investors’ such as Jeff Bezos, who seems to be happy throwing around 3 million dollars into the pot every day.

It also includes those lined up by maverick entrepreneurs such as Richard Branson who has no issue with creating new companies ready to spend the funds they attract. Despite not having made a dollar from existing projects they have funded.

The number of venture capital firms investing in the space industry is growing day in day out, some will turn a profit, some won’t. But as it stands right now, these firms look like they are here to stay, despite the inevitable rough rides and mission-aborts many of them are about to experience in 2018 and beyond.

![Yikes! Apparently people have been making Uranus jokes at least since this 1881 edition of the satirical magazine Puck.

[Found by Elizafox System on Mastodon]](https://pbs.twimg.com/media/FwWGy-DWAA4v1SQ.jpg)