Contents

- Why are venture companies investing in the space industry

- Top venture companies that have invested in space businesses

- 1. Bessemer Venture Partners investment in Skybox Imaging

- 2. Khosla Ventures space investments

- 3. Canaan Partners and Norwest Venture Partners

- 4. Draper Fisher Jurvetson

- 5. Google and Fidelity investment in SpaceX

- 6. $500 million funding for the company OneWeb

- 7. Founders Fund

- 8. E-Merge

- 9. RRE Ventures

- 10. First Round Capital

- Final thoughts

However, as we have seen over the past few years, there has been a steady rise of private space companies that are independent of governments, which have been undertaking a lot of space exploration and investment activities.

These companies have helped to eliminate the monopoly that has existed in the space industry for several decades, as well as intensify the exploration of space after budget cuts that are currently facing government-funded space agencies.

This new development has also opened up new opportunities for investors, which has seen several venture capital firms starting to invest in and market space brands.

Why are venture companies investing in the space industry

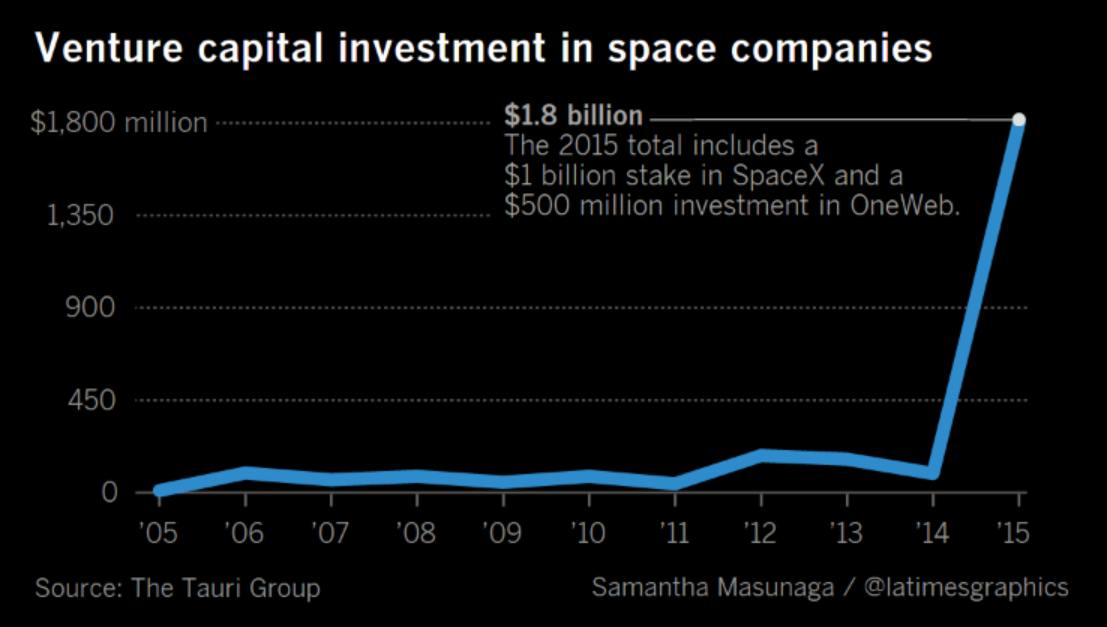

Over the past few years, investment in space businesses has increased steadily, reaching an all-time high in 2015 when venture capital firms invested $1.8 billion, a record high. According to a report released by The Tauri Group, a company that offers aerospace and defence consultancy services, more than 50 venture capital firms invested in space businesses in 2015. But, why are these firms investing in an industry that has been viewed by most venture capitalists to be risky and slow in yielding returns in the past? Below is a look at some of the top reasons why venture capital firms are racing to invest in the space industry:

1. The promise of high returns

Profit is the main motivation for venture capital firms when they are searching for businesses to invest, and the space businesses offer them just that. The high-end technology that is developed by space companies, for example, rockets, satellites, and space resupply vehicles, can provide very lucrative returns, thus attracting several capital venture firms.

The space industry also offers a promise of high returns from ventures such as space tourism and natural resources that can be found in space. In fact, some space companies have already been established with a sole purpose of mining rich resources found in the space once the activity becomes viable. Other space businesses are also currently developing technology such as spacecrafts that will be used in space tourism. And while these activities might not be currently viable, they will be a huge gold mine for investors once they are successful.

2. Ease of assessing the viability of space businesses

As already stated, when space exploration started a number of decades ago, almost all of the activity was funded and carried out by government agencies. This created a monopoly in the space exploration, and at the same time, made it impossible for investors to assess the viability of investing in the space industry. However, in the past few years, several space businesses have been established, which as taken the monopoly of space exploration away from governments.

The presence of these space businesses has also made it easier for venture capital firms to assess the viability of investing in the industry, as they can be able to look at which companies are performing well, just the same way they would assess other companies they are considering to invest in sectors such agriculture, energy, telecommunication, and others.

3. Increase in the number of space businesses

Another reason why venture capital firms are entering into the space industry is the increase in the number of businesses that operate in the space industry. According to New Space Global, a company that tracks and provides information about space businesses, there are about 1,000 space businesses that are currently involved in space activities, a significant increase from just 100 companies in 2011.

The company also predicts that the number of these companies will continue to increase as the process of commercialising the space intensifies. This development has helped to show venture capital firms and other investors that the space industry is a viable investment opportunity, thus diminishing the long-held view that it is risky – after all these companies are generating huge profits from their activities.

4. The prestige that comes with investing in the space industry

When space exploration started, there was a huge space race between countries, as nations – mainly the USA and Russia – competed with each other in the exploration of the final frontier. The competition to explore the outer space reduced over time, but it has been revived in the past few years, and this time around it is being led by companies. In what is being termed as “space race 2.0”, companies all over the world are competing to make huge milestones in the exploration and commercialisation of the space, and just like with the original space race, prestige is a huge motivation.

Investment in the great billionaire's 'space race 2.0' is motivated by prestige. #spacerace Click To TweetVenture capital firms have also not been left behind in this new space race, and several investors are venturing into the space industry with the hopes that they will be associated with prestigious space projects such as space tourism or sending humans to Mars. This has helped to create a huge boom in the space industry, thus encouraging more investment in space.

5. The commercial application of space exploration

In addition to the yields of the space businesses, the commercial application of the high-end technology developed by the space industry is another major reason why space venture capital firms are investing in the industry. For example, the satellites that are developed and launched into space by space companies are very useful in the defence industry.

Miniaturized satellites (CubeSats) are also being used widely to provide images and data to various sectors such as agriculture, energy and oil, and even hedge funds – where they are used to monitor various economic spots in the world and provide data that can be used in tracking investment signals. Venture capital firms are thus reaping huge profits from investing in space, and at the same time, gaining access to high-end technology that can be used for other ventures on earth.

6. Reduced cost of space exploration

One of the main challenges that capital venture firms face when investing in space businesses is the high cost of space exploration, which translates to high investment costs. However, over the past few years, the cost of exploring the final frontier has been reduced significantly due to the entry of several businesses into the industry, which has increased competition and led to the innovation of more cost-effective technology – for example, reusable rocket technology by SpaceX, which has the potential of bringing down the cost of sending payloads into space by about $60 million. The reduced cost of space exploration has also helped to make the space industry more profitable, thus attracting more investors into the industry.

Top venture companies that have invested in space businesses

The past few years have seen a decrease in government funded space projects, but this has not diminished the future of the industry. Instead, entrepreneurs have ventured into the space industry, taking over the exploration and helping to intensify the commercialisation of the final frontier.

This has created a very lucrative investment opportunity, which has helped to attract several venture capitals looking to make huge gains from this profitable, yet under-invested sector. Below is a look at some of the top venture capital investments in space businesses over the past few years.

1. Bessemer Venture Partners investment in Skybox Imaging

Bessemer Venture Partners is one of the first venture capital firms to invest in the space industry, having been involved in the funding of Skybox Imaging, a space company that introduced the use of miniature satellites (CubeSats). The investment, which was made in 2010, paid off well for the firm, as Skybox was acquired by Google in 2014 at a price of $500 million.

In addition to Skybox, Bessemer Venture Partners has also made other investments in the space industry, including a recent investment in Rocket Lab for the development of an Electron Orbital Vehicle. The company also announced the setting aside of a $1.6 billion investment fund, which will be used to invest in various innovative companies including those in the space industry.

2. Khosla Ventures space investments

Khosla Ventures is also another premier space capital venture firm, and it is considered to be one of the most active venture capital firms, with an investment portfolio that includes leading space companies such as Rocket Lab, Skybox Imaging, and the Climate Corporation. Khosla Ventures was the first capital venture firm to invest in Skybox Imaging in 2009 with a $3 million funding. It was also involved in the second round of funding for the company in 2010, alongside Bessemer Venture Partners.

3. Canaan Partners and Norwest Venture Partners

Canaan Partners and Norwest Venture Partners are two other venture capital investment firms that have invested in space businesses in the recent years. The two companies were involved in the third round of funding for the company Skybox Imaging, joining the initial capital venture investors – Bessemer Venture Partners and Khosla Ventures – to raise $70 million dollar funding. This led to a total 0f $91 million, the amount of money invested in Skybox Imaging by venture capital firms.

4. Draper Fisher Jurvetson

Draper Fisher Jurvetson is one of the most active space venture capital firms, and they have been eyeing the current space boom for a long time now. The company was one of the earliest investors in SpaceX, one of the leading commercial space companies in the world. It has also invested in other space businesses such as Planet Labs (miniature imaging satellite manufacturer), Mapbox, Huaxun Microelectronics, and ALOHA Networks.

5. Google and Fidelity investment in SpaceX

One of the largest venture capital investment was the $1 billion investment in the space company SpaceX, which brought the 2015 total investment in the space industry to an all time high. The main investors in this funding were Google and Fidelity, and the investment helped to increase the space company’s value to $12 billion. The funding will be used in the proposed space-based internet project, where SpaceX plans to launch 4,000 satellites into the low earth orbit.

6. $500 million funding for the company OneWeb

Another significant venture capital investment in space businesses is the $500 million funding of the space company OneWeb, for a global space-based internet project similar to that of SpaceX. The funds, which came from investors such as Qualcomm and Virgin (a space company, remember) will be used to develop and launch hundreds of satellites into space for this project.

7. Founders Fund

Founders Fund is an American venture capital investment firm that invests in various sectors, including the space industry. Founders Fund was one of the first venture capital investment firms to invest in SpaceX (alongside Draper Fisher Jurvetson). The company has also invested in several other space businesses such as Accion Systems, Moon Express, Planet Labs, and The Climate Corporation.

8. E-Merge

E-Merge is a venture capital investment firm based in Brussels, which invests in various sectors including e-commerce startups, telecommunication, and even space businesses. The firm entered into the space industry in 2012 with an investment in the CubeStats. Their investment portfolio includes the space companies Spire Global and NanoRacks.

9. RRE Ventures

RRE Ventures is a leading venture capital investment firm in the US, which has investments in over 225 companies. The firm invests in a number of sectors, including telecommunication, financial services, software development, and even space. While it may not be one of the largest investors in the space industry, it has a considerable space investment portfolio that includes the companies Spire Global, Accion Systems, and Spaceflight Industries.

10. First Round Capital

First Round Capital is a venture capital firm based in the USA, which provides funding to tech companies in their early stages. The company has a huge investment portfolio in 287 companies, including the space companies Planet Lab, Swift Navigation, and the Climate Corporation.

Final thoughts

More than 50 #venturecapital firms invested in the #commercialspace industry. #newspace Click To TweetThe last 5 years have been a great period for the space businesses, where venture capital investment increased significantly, reaching a record $2.7 billion in 2015. The number of venture capital investment firms that are investing in the space businesses has also been on the rise, and according to space start-up report, there were more than 50 venture capital firms that invested in the space industry in 2015.

Huge companies across the world such as Google have also ventured into the space industry, with Google acquiring Skybox Imaging in 2014 and contributing to the $1 billion SpaceX investment in 2015. What we will see when the 2016 figures are released is likely to reflect this boom. Of course this is great news for the space industry as it shows that venture capital investment firms are increasingly ready for further investment in the commercial space sector in 2017 and beyond. Though who will be releasing and who will be receiving those funds, is yet to be seen.

![Yikes! Apparently people have been making Uranus jokes at least since this 1881 edition of the satirical magazine Puck.

[Found by Elizafox System on Mastodon]](https://pbs.twimg.com/media/FwWGy-DWAA4v1SQ.jpg)